Your Tax Filing Journey with Community Tax Aid:

1. Getting Information

Many clients, like you, learn about our helpful services from friends or family in the community who were happy with our work. When you visit our website, we’re glad to see you! Take some time to learn about what we do and what you should expect during each step of the process.

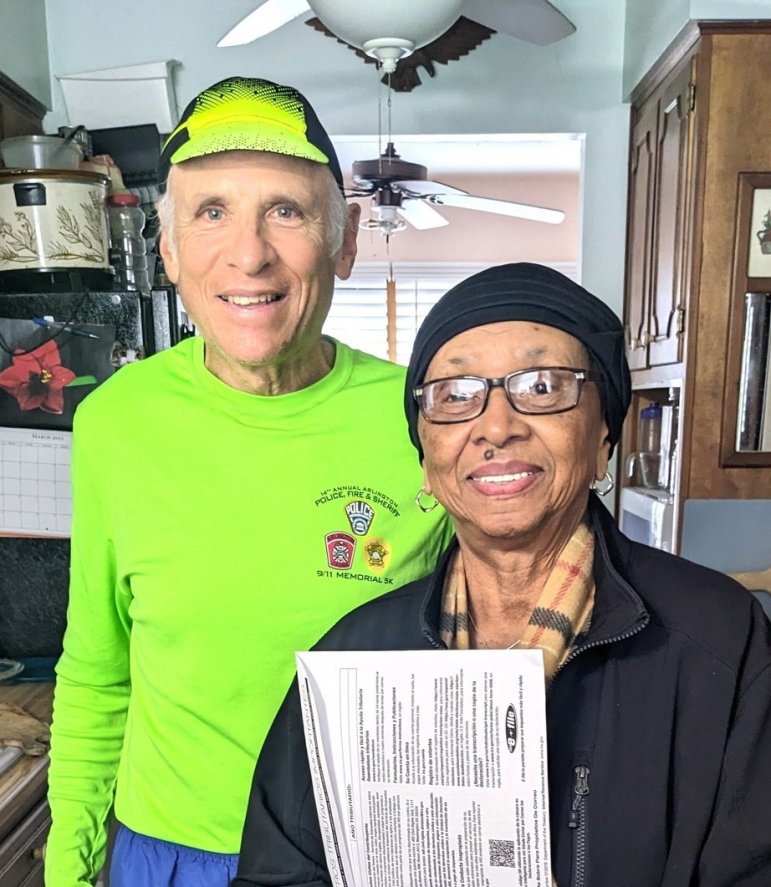

2. Making the Appointment

To make an appointment, all you need to do is call us and leave a message. Someone from our team will call you back quickly to help you schedule an appointment in the next two weeks.

Flexible Options: We understand everyone has different preferences. You can choose to meet us in person or connect with us virtually online. Depending on what you pick, you can either come to one of our tax sites or use our online services to handle everything smoothly and quickly. If you pick the online option, you can send us all your important documents securely, which helps speed up getting your tax refund.

3. At Your Appointment

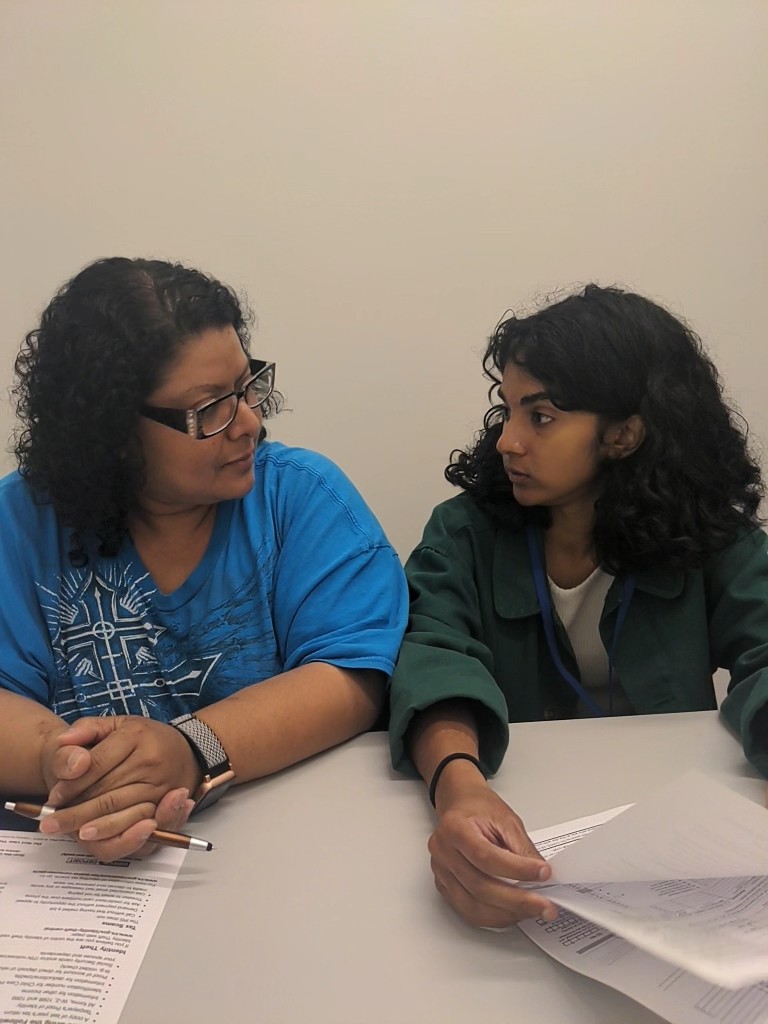

Intake:

You’ll start by filling out some important forms that help us understand your tax situation and what you need. This step is simple but very important.

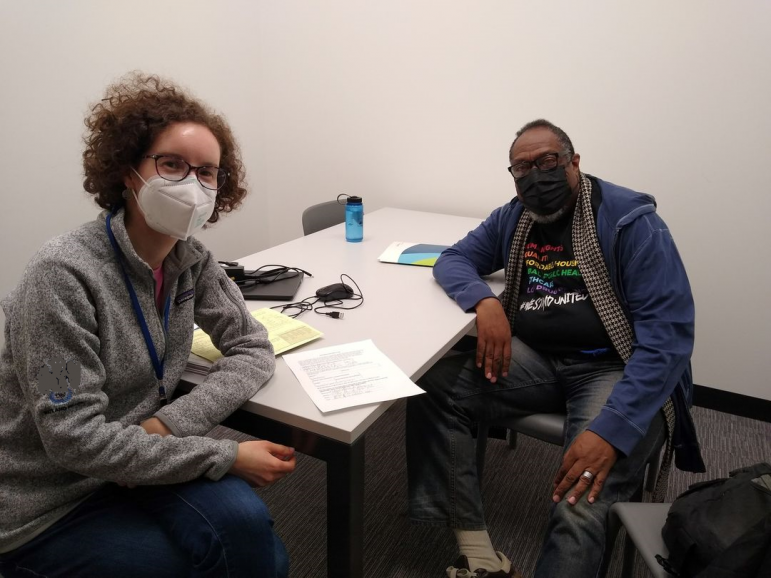

Prep:

After you give us your completed forms, our experienced team will start working on your tax return. We’ll organize all your financial information and put it into our advanced tax software. If you chose the virtual or drop-off option, we might call you if we need more information or documents to finish your tax return accurately.

Review:

Once your tax return is ready, it will be checked carefully. Our team will look at every detail to make sure it’s accurate and follows all the current tax rules. They will make sure you get every tax benefit you qualify for. If anything needs to be fixed or changed, it will be taken care of at this step.

4. Return and Signature

Approval: After the review, your tax return will be approved.

Resolution & Re-submission (if Necessary):

If there are easy-to-fix issues, our team will correct them and resend your tax return. For more complicated problems where we need your help – like if there’s confusion about dependents – we’ll contact you to clear things up before resending the tax return for approval.

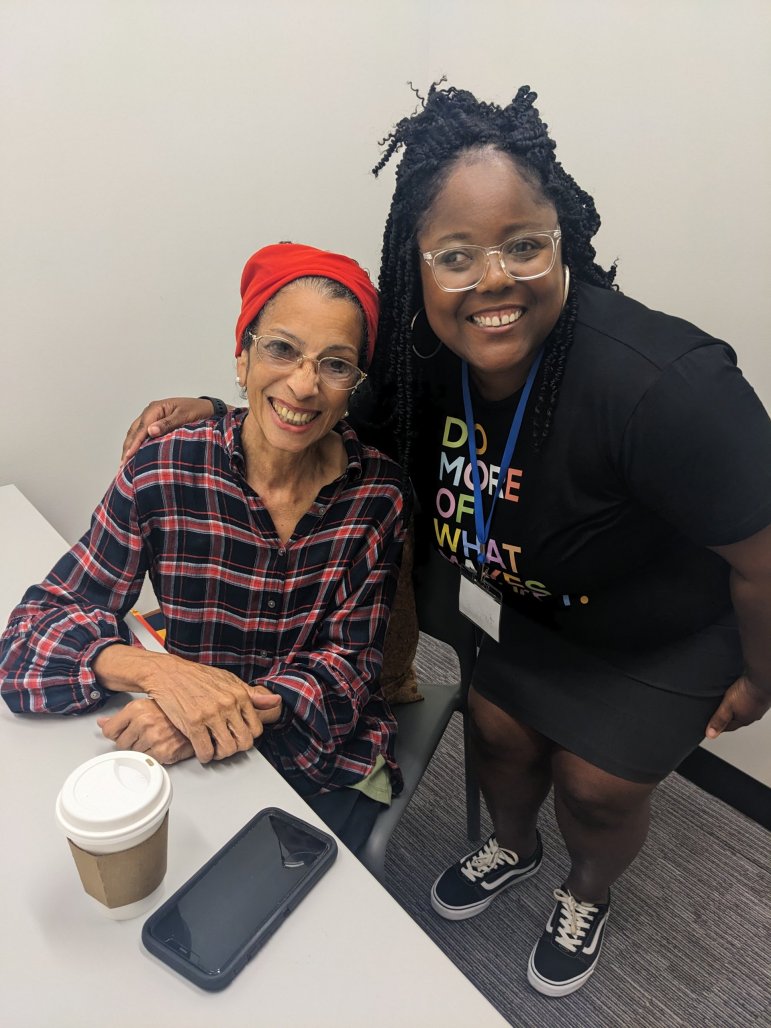

5. Follow-Up and Support

We’re here for you, even after your tax return is filed. If you have questions or if you hear from the IRS or your state’s tax department, don’t hesitate to contact us. We’re ready to help with any issues or questions you might have after the filing process.